The world is dying of machinery; that is the great disease, that is the plague that will sweep away and destroy civilization; man will have to rise against it sooner or later.

—George Moore, 1888Trust Issues

Compound interest can help save for the future, or it can bankrupt the world.

By Paul Collins

An Imagined View of the Bank of England in Ruins, by Joseph Michael Gandy, 1830.

Audio brought to you by Curio, a Lapham’s Quarterly partner

Hartwick College didn’t really mean to annihilate the U.S. economy. A small liberal-arts school in the Catskills, Hartwick is the kind of sleepy institution that local worthies were in the habit of founding back in the 1790s; it counts a former ambassador to Belize among its more prominent alumni, and placidly reclines in its berth as the number-174-ranked liberal-arts college in the country. But along with charming buildings and a spring-fed lake, the college once possessed a rather more unusual feature: a slumbering giant of compound interest.

With bank rates currently bottomed out, it’s hard to imagine compound interest raising anyone much of a fortune these days. A hundred-dollar account at 5 perecent in simple interest doggedly adds five bucks each year: you have $105 after one year, $110 after two, and so on. With compound interest, that interest itself get rolled into the principal and earns interest atop interest: with annual compounding, after one year you have $105, after two you have $110.25. Granted, the extra quarter isn’t much; mathematically, compound interest is a pretty modest-looking exponential function.

Modest, that is, at first. Because thanks to an eccentric New York lawyer in the 1930s, this college in a corner of the Catskills inherited a thousand-year trust that would not mature until the year 2936: a gift whose accumulated compound interest, the New York Times reported in 1961, “could ultimately shatter the nation’s financial structure.” The mossy stone walls and ivy-covered brickwork of Hartwick College were a ticking time-bomb of compounding interest—a very, very slowly ticking time bomb.

One suspects they’d have rather gotten a new squash court.

The notion of a “Methuselah” trust has a long history—and as with many peculiar notions, Benjamin Franklin got there first. Upon his death in 1790, Franklin’s will contained a peculiar codicil setting aside £1,000 (about $4,550) each for the cities of Boston and Philadelphia to provide loans for apprentices to start their businesses. The money was to be invested at compound interest for one hundred years, then a portion of the fund was to be used in Boston for a trade school. For Philadelphia, he recommended using the money for “bringing, by pipes, the water of Wissahickon Creek into the town”—or perhaps “making the Schuylkill completely navigable.” The whole scheme was perfectly suited for a man who once half-jokingly proposed that, in preference “to any ordinary death” he be “immersed in a cask of Madeira wine” for later revival, as he had “a very ardent desire to see and observe the state of America a hundred years hence.”

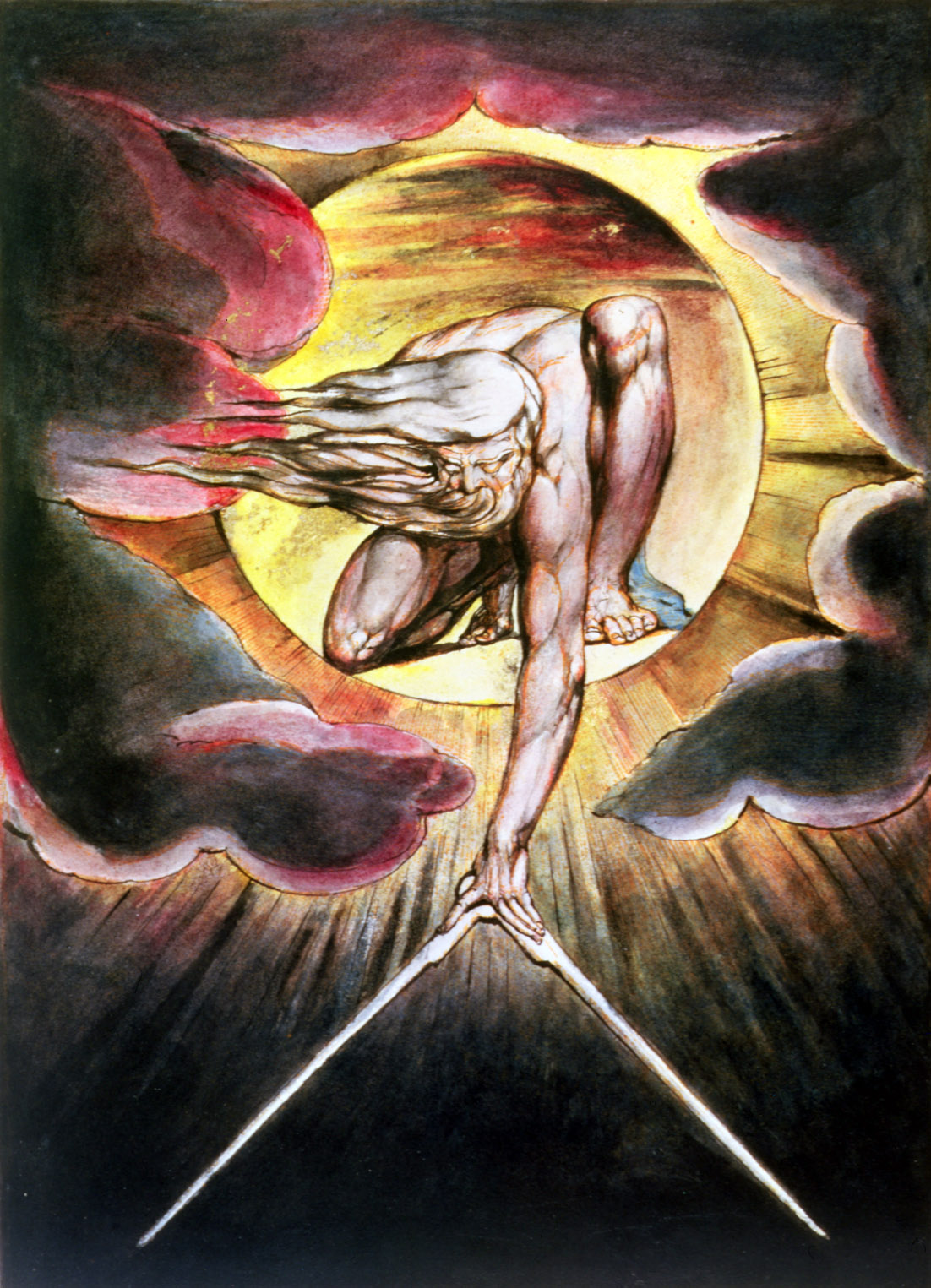

The Ancient of Days, frontispiece for Europe a Prophecy, both by William Blake, 1794. The Fitzwilliam Museum, Cambridge, United Kingdom.

Franklin’s plans soared beyond a mere century, though. After a portion of the funds were to be paid out for a first set of public works, the remainder was then to grow for another century—until, by Franklin’s estimate, in 1990 both cities would receive a £4,061,000 windfall from their most famous native son.

“Considering the accidents to which all human affairs and projects are subject in such a length of time,” Franklin admitted, “I have, perhaps, too much flattered myself with a vain fancy that these dispositions, if carried into execution, will be continued without interruption and have the effects proposed.”

Nonetheless, Franklin’s experiment inspired Peter Thellusson, a London merchant and a director of the Bank of England, to even dizzier heights. Thellusson had an impressive fortune of some £600,000 by his death in July 1797, worth about $68 million today. But at the reading of the old financier’s will, his reckless sons received the shock of their lives. “It is my earnest wish and desire,” he lectured them from beyond the grave, “that they will avoid ostentation, vanity, and pompous shew; as that will be the best fortune they can possess.”

It would also be almost the only fortune they’d possess. Most of the estate was to be invested at compound interest until every currently existing heir was dead, whereupon upward of £19 million would cascade onto their distant descendants. It was as if, one legal scholar marveled, Thellusson had “locked his treasure in a mausoleum and flung the key to some distant descendant yet unborn.”

His heirs did not take the news well: one took out a pistol and shot the old man’s portrait.

It was the opening salvo of an immense legal battle. The Thellusson will occupied courts for decades, involving the country’s top legal talent; law professor Patrick Polden of Brunel University, who authored a monograph on the case, has tallied over one hundred lawyers involved in the judgment. Politicians and gentry waded in out of concerns far beyond the heirs’ resentments. “There was a major political dimension too,” he explains. “The fear was that when the trust expired these two or three mega-rich men would be able to exert a massive influence through buying up seats in the House of Commons and that they would establish dynasties of peers; worse, that others would follow suit.”

By the time the case was resolved sixty-two years later in 1859, much of the fortune had been consumed in legal fees, and Parliament enacted the Perpetuities Act barring Britons from ever attempting Thellusson’s stunt again. Perhaps, in the end, a dynastic trust that locked up money for generations simply smacked too much of feudalism for Britain’s new industrial economy.

“A fortune in circulation,” explained one judge from the case, “even if spent in luxuries, waste, and dissipation, did more good to the public.”

If Peter Thellusson left any real legacy, it was in inspiring Charles Dickens to create the endless case of Jarndyce v. Jarndyce in his 1853 novel Bleak House:

This scarecrow of a suit has, in course of time, become so complicated that no man alive knows what it means…Innumerable children have been born into the cause…Innumerable old people have died out of it. Scores of persons have deliriously found themselves made parties in Jarndyce and Jarndyce, without knowing how or why; whole families have inherited legendary hatreds with the suit. The little plaintiff or defendant, who was promised a new rocking horse when Jarndyce and Jarndyce should be settled, has grown up, possessed himself of a real horse, and trotted away into the other world.

The unimpeded growth of a huge sum of money, central to the Thellusson case, was even more fascinating to authors. The 1899 H.G. Wells novel When the Sleeper Wakes features a wealthy young man who sleeps for 203 years after an 1897 drug overdose, only to discover upon his revival that his unattended bank account has funded an entire totalitarian society. Like the bank account and the society it created, Wells later deemed the story “one of the most ambitious and least satisfactory of my books.” That didn’t keep the eccentric pulp writer Harry S. Keeler from going even further with the 1914 story “John Jones’ Dollar,” in which a solar system’s economy is built around a single silver dollar left to accumulate until the year 2921 to the astounding sum of $6.3 trillion—an amount deemed roughly equal to “the wealth on Neptune, Uranus, Saturn, Jupiter, Mars, Venus, Mercury, and likewise Earth, together with an accurate calculation of the remaining heat in the sun and an appraisement of that heat at a very decent valuation per calorie.” Instead of bankrupting the solar system, though, it finances an interplanetary socialist paradise.

The story may be absurd, but it was just that kind of mathematical absurdity that had captured Franklin’s fancy in the first place. A few years before Franklin drafted his will, philosopher Richard Price rhapsodized in a sober treatise on the national debt, “One penny, put out at our Savior’s birth to 5 percent compound interest, would, in the present year 1781, have increased to a greater sum than would be contained in two hundred millions of earths, all solid gold. But, if put out to simple interest, it would, in the same time, have amounted to no more than seven shillings and sixpence.”

When the first century of Franklin’s rather more practical plan arrived in 1891, it bore $572,000 for Boston and Philadelphia. That was hardly one earth of solid gold, let alone 200 million of them, but Franklin had made his point—and in particular, he’d made it to a New York lawyer named Jonathan Holden.

Trained in law at Colgate and a multimillionaire through property investments, Holden was the sort of fellow who gave himself haircuts to save money, advocated the use of phonetic spelling in English, and lived on a diet of prunes and shredded wheat. By 1912, as the founder of what he christened “The Futurite Cult”—a few of its publications still survive in far-flung libraries—he’d concluded that the earth had achieved “a stage of civilization when vested property rights will be unmolested even in the case of conquest.” The time was right, he decided, to take Franklin’s grand economic experiment to its next logical step.

“One of the first American statesmen performed an act which is suggestive of possibilities,” Holden said of Franklin in a 1912 pamphlet, wondering whether “some citizen of the present day felt disposed to carry the ‘Franklin Plan’ still further.”

That citizen would be Holden himself. Beginning in 1936, he sluiced $2.8 million into a series of five-hundred- and thousand-year trusts—just one of which, allocated to the Unitarian Church, would be worth $2.5 quadrillion upon its maturation in the twenty-fifth century. A thousand-year fund dedicated to the state of Pennsylvania would yield $424 trillion; the money was to be applied to abolishing the state’s taxes. Holden didn’t even live in Pennsylvania—he’d picked the state as an homage to Franklin.

And then, of course, there was Hartwick College. Choosing them for a thousand-year trust was more straightforward: Holden had two children and one grandchild attend the school. Then again, as a man fixated by compound interest, perhaps Jonathan Holden was simply enchanted with the college’s motto of Ad Altiora Semper: “Ever Upward.”

The trustees overseeing these immense funds would be Holden’s own children, and perhaps in turn their own descendants. Though not necessarily rich themselves, they would control great riches—and so, long before passing away in 1967 at the age of eighty-six, Holden decided that after his death, the world would still need a way to clearly distinguish the next fifty generations or so of these munificent descendants. Holden was a common name, but Holdeen was not; with a trip to the courthouse, the lawyer added an “e” to his last name.

The old man never did manage to talk any of his children into adding the extra “e” to their names as well. But it hardly mattered: as far as he was concerned, the Holdeen dynasty had begun.

Ten years after Holdeen’s death, in a Pennsylvania courtroom in 1977, economist Jack Rothwell laid out the Armageddon that awaited the state. As the trustees of an increasingly vast fund, Holdeen’s descendants would gradually control ever-larger swaths of currency. The Holdeen Trusts, he argued, would grow until “They would absolutely own the world.”

“Any time you wanted to make a telephone call or take a trip…You would be paying money to the Holdeens,” added economic forecaster Michael Evans. “Everyone in the world would work for the Holdeens.”

It wasn’t the first time the court had heard this argument. Even within his own lifetime, Holdeen’s plans nearly disappeared into a maze of lawsuits. In some cases the federal government had opposed the trusts on tax grounds, while in others the state government of Pennsylvania had defended them out of self-interest; some beneficiaries of the funds opposed their breakup, while others wanted to smash open the piggy bank a thousand years early. More ominously, in 1958 the IRS had clashed with Holdeen, arguing in court that it had rightly demanded taxes off of what it considered an invalid tax shelter. The trusts, the IRS argued, would in any case wreck “the tax base of the nation, if not the world.”

“Flying Fireman,” color lithograph from the series Visions of the Year 2000, by Jean-Marc Côté, 1899.

Although the judge in that case mused the eventual size of the funds meant that “in this day of space exploration…Possibly other worlds will have to be discovered for the plaintiff’s future investments,” the funds nonetheless survived a number of early challenges. Their survival owed much to their being more high-minded than Thellusson’s scheme for enriching his family. Although nearly all states had perpetuity laws like Britain’s, there was more leeway given to charitable trusts like Holdeen’s. One hundred-year account, set up by suffragette Anna C. Mott, dumped $215,000 on Toledo in 2002—rather more than the thousand dollars she started with—and similar funds were created in the 1920s to relieve Britain from its national debt. In 1919, the Indiana legislature even passed a law to allow a charitable five-hundred-year trust by Charles Fairbanks, an Indiana senator who had also served as vice president under Teddy Roosevelt.

But while some trusts accumulated for a century or two, and others were created with yearly payouts in perpetuity, none were accumulating in near perpetuity. Even Franklin’s fund, after a solid two-hundred-year run, finally ended in 1990 with a bounty for the Franklin Institute in Philadelphia and the Benjamin Franklin Institute of Technology in Boston. The roughly $7 million total payout didn’t quite attain the heights that Franklin predicted; such plans rarely factor in the cost of trustees’ fees, taxes, or legal battles. But if Franklin’s trusts survived at least relatively unscathed, it was the sheer ambition of the Holdeen trusts that would finally give America a decades-long legal fight worthy of Jarndyce v. Jarndyce.

“This stuff is endless,” one court staffer groaned to a Philadelphia Inquirer reporter in 1994. “It truly is endless.”

Eventually the Holdeen trusts were allowed to stand, but they paid out yearly instead of accumulating and compounding. The matter was not truly settled until 2005, a full ninety-two years after Jonathan Holdeen first wrote his will. That was when Haldis Holden MacPherson, the sole surviving original trustee, died in Poughkeepsie. With her, the last defender of the Holdeen dream died as well.

These days, perpetual trusts are old hat: American laws against them have been steadily rolled back in the last two decades, thanks to a banking lobby that rather likes the idea of keeping your money forever. For those with less to spend, there’s even a Time Travel Fund website puckishly set up for would-be travelers who shell out ten bucks by Paypal—money that would be compounded to pay future peoples to retrieve you from your present cash-poor existence. Perpetually accumulating trusts, though, are not much more likely to be allowed to take over the world now than they were in 1912.

Time will reveal everything. It is a babbler and speaks even when not asked.

—Euripides, 425 BCAnd so, after decades in the courts, Holdeen’s economic Armageddon ended not with a bang, but with a whimper—and a dividend check.

Hartwick College got its thousand-year trust, still bearing its maturation date of 2936; the principal now stands at an impressive $9 million. Rather than accumulating and compounding, though, the trust pays out roughly $450,000 a year to the college. This, a 2008 Hartwick press release announced, “represents the second largest gift to the college” in its history.

“It’s an enormous gift,” enthused Hartwick’s president to their local newspaper. “This is going to be of tremendous benefit to the college.”

And then it disappeared. Not the money, mind you. But visit Hartwick’s website today, and you’ll no longer find that press release, or much else relating to Holdeen. No dormitory wing, no scholarship, not even a luncheon—nothing. So what happened?

“The College utilizes the income to fund annual expenditures related to our physical plant,” the school’s director of donor relations explained in an email to me. In short, the money is liable to go toward paying for water bills and groundskeeper carts and the like: when you turn on a light at Hartwick, Holdeen’s bright idea is helping to pay for it. But the man who changed his name so that it would last a thousand years? He forgot to ask that it be attached to anything. And nobody alive today, it seems, could care less.

“There is no recognition currently,” the director said, “and I am not aware of an event recognizing the gift.”

The past can dictate the terms of a will, but the future dictates who it actually cares to remember. And so it is that Jonathan Holdeen—the man whose trusts were once said to threaten the U.S. economy with annihilation—does not have so much as a picnic table named after him.